Cost of living crisis:

A Study on How Consumers and Brands are Forced to Respond

This is the first article in our Cost of Living series: a collection of articles examining the impact and implications of the cost of living crisis. Stay tuned for the next two articles!

Brand and Consumer Strength Against World Issues

Nothing proves the resilience of humans more than a worldwide crisis. During the pandemic, for example, we had to cope with intense loss, uncertainty, and interruptions in our daily routines. Once again, our resilience is being tested. Another impactful event has emerged: the rising cost of living.

MetrixLab’s Cost of Living Study

Let’s face it. The global economy is shaky right now, and the consequences are severe. Everyday, consumers are confronted with high inflation. Shopping for food and necessities has become a grueling experience. MetrixLab studied this issue closely in our Cost of Living Study. To survive and thrive, brands must know and respond properly to consumers’ exact behaviors.

Results from MetrixLab’s Cost of Living Study

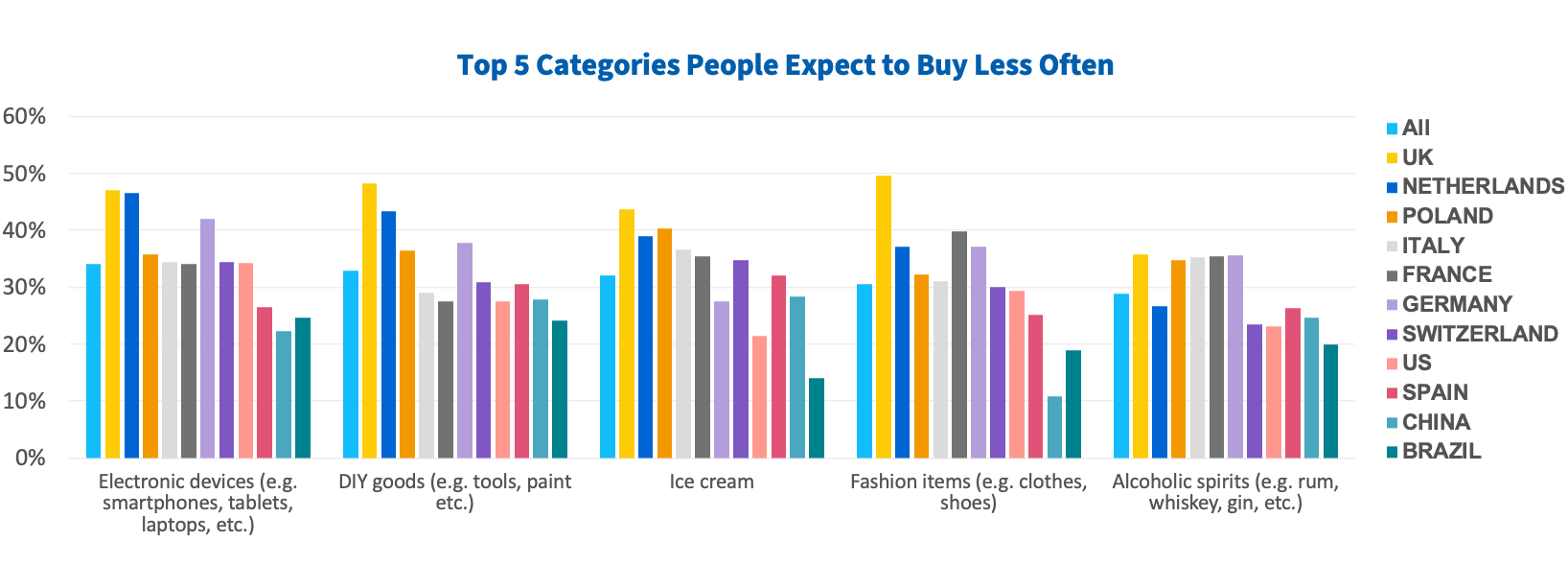

To illustrate the impact of the cost of living crisis on consumers’ daily lives, we studied 11 global markets: Brazil, China, France, Germany, Italy, the Netherlands, Poland, Spain, Switzerland, USA, and the UK.

European households are more likely to cut back their spending across multiple categories, starting with technology.

Our findings are confirmed by a recent report by the global consultancy, Deloitte. “The overwhelming majority of respondents (78%) remain concerned about rising prices, and consumer spending intentions continue to weaken relative to the Fall of 2021 – especially around more discretionary categories (like recreation and entertainment, leisure travel, restaurants/takeout, electronics, and home furnishings).”

Source: State of the US Consumer: February 2023

What Successful Brands Do in Response

How should brand respond to an economic crisis when consumers are curbing their spending?

The Reactive Brand Leader Response

One option is to act out of emotion and immediately reduce staff and/or cut the marketing budget. While understandable, that response is problematic. Emotional, in-the-moment decisions can lead to operations and revenue issues later on when the economy stabilizes. Unfortunately, many brand leaders take this approach.

The Proactive Brand Leader Response

Another option is to take a breath, and conduct an in-depth review of your marketing plan. Review the five P’s of your marketing strategy – Product, Price, Promotion, Place, People – to identify opportunities where your brand can stand out from competitors. Collect all of the data you can on which marketing efforts are driving revenue or adding other crucial value.

Try to take only the actions that will create the most impact, i.e. revenue savings without sacrificing customer experience or product quality, for your brand and customers. Additionally, stay vigilant about your mindset. Keep your focus on weathering this storm knowing prosperous times will arrive. With this response, you set your business up to shine in the post-recession world.

“If you can keep your head and your marketing budget, while those around you are losing theirs, you will be a marketer my friend. And a successful one at that.”

Mark Ritson

A systematic review[1] of (un)successful marketing mix strategies during recessions reveals that “Firms which are agile and implement proper business strategies during a crisis are more likely to survive and shine, whereas others will disappear.”

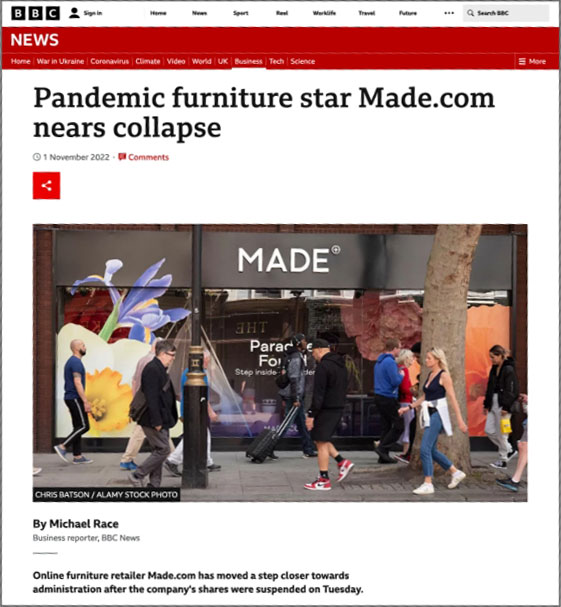

Pandemic furniture star Made.com nears collapse

Made.com, which sources directly from designers and manufacturers, gained a loyal base of younger customers and employed 700 staff at the end of 2022. The retailer was one of many companies that saw sales surge during the pandemic as people bought more furniture online during lockdown. But more recently, the company has experienced problems related to the rising cost of living. Households have cut back on or delayed big-ticket purchases in favor of saving money and purchasing only necessities. Global supply chain issues have also left customers waiting months for deliveries.

The Importance of Pricing in 2023

Dr. Grace Kite, econometrician and founder of Magic Numbers, sees 2023 as “the year of price.”

What does that mean?

“Brand leaders need to prioritize strategies that convince consumers their product is worth paying for,” according to Dr. Kite. The cost of living crisis has revealed the need for brand leaders to take into account their full competitive context. This includes their own label products from retailers.

Brands across the world have been scrutinizing their own pricing with great results. Some companies have reported higher revenue numbers coming from smaller volumes. According to Unilever’s Full Year 2022 results announcement, ”Underlying sales growth stepped up to 9.0% in 2022, led by pricing. This had some negative impact on volumes, which declined 2.1%.”

2023 Pricing Strategies

There are a few ways brands persuade consumers their product is worth paying for, and in doing so avoid losing share:

- Maintain prices and increase quality

- Reduce prices while maintaining quality

- Avoid lowering prices and quality at the same time, which would slowly erode your brand’s perception

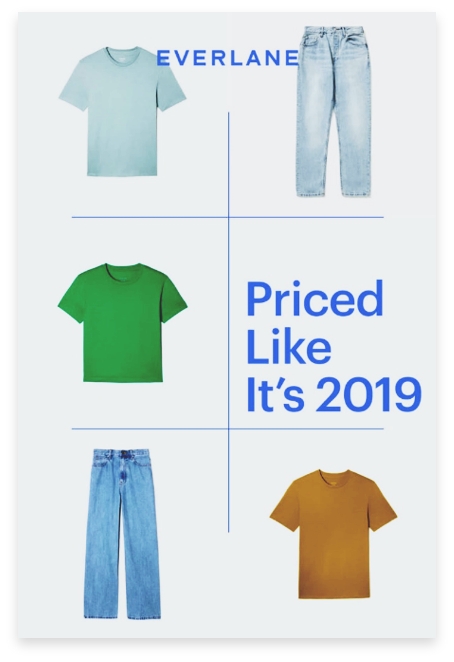

Everlane, an American clothing retailer selling mostly online, is a great example of a brand that prioritizes pricing in 2023 amidst high inflation. Here is their messaging from 2022:

Consumer v. Brand Beliefs About the Future

Consumers feel the world is shifting around them in unpredictable ways. Over 30% of consumers we spoke to feel like things won’t ever return to normal, while another 28% anticipate the recovery taking more than a year.

These consumer beliefs aren’t unfounded. The global economy is still fluctuating. In the January 2023 World Economic Outlook Update, the IMF forecasts that global growth will fall to 2.9% in 2023, but rise to 3.1 percent in 2024. Additionally, rising interest rates and the war in Ukraine continue to weigh on economic activity.

The future decrease in inflation can help brands project their success. But brands must remember that the short-term effects of inflation right now are still hurting consumers.

Wrap-up

Data supports that a more prosperous future is ahead. The economy is projected to stabilize. That’s great news. But consumers aren’t buying it – or much else – for now.

How should brands respond? By ensuring their pricing strategy enables them to maintain volume or market share right now and set them up to drive growth long-term.

If brands can muster the resilience they exhibited during the pandemic – and direct that resilience with strategic action – they’ll have success now and well into the future.

Key Highlights

Consumers experience uncertain times where increasing prices – not restricted to the energy sector – impact daily lives.

In MetrixLab’s Cost of Living-study we interviewed consumers in 11 markets to see how they make ends meet and to better understand people’s thoughts, feelings and needs.

The data shows us that more than half of the households studied are curbing or delaying their spending right now.

Brands should face this change in consumer behaviour. Brands who can navigate the recession well, build a stronger future for themselves and for their market.

[1] Note: Nikbin, D., Iranmanesh, M., Ghobakhloo, M., & Foroughi, B. (2021). Marketing mix strategies during and after COVID-19 pandemic and recession: a systematic review. Asia-Pacific Journal of Business Administration

This is the first article in our Cost of Living series: a collection of articles examining the impact and implications of the cost of living crisis. Stay tuned for the next two articles!