Extracting mindset-changing insights from user-generated content

Social insights provide a whole other dimension of consumer research. They help us better understand people’s attitudes towards brands, products and services. User‐generated content (UGC) is spontaneous.

Consequently, it often provides a truer picture of what people think. There is also a huge amount of UGC being generated all the time. With all this in mind, you can see the wealth of information available to brands via social insights.

We’re experts in social insights at MetrixLab. We’ve helped world‐leading brands to harness their power. This has enabled them to identify opportunities, develop their products/services and optimize their marketing to gain a competitive advantage.

In this paper, we explore how you might use social insights to do the same. We do this using a recent study of cat owners’ attitudes towards and preferences for the feline food they buy. Anyone who has spent any time on social media will know there’s a lot of user‐generated content about cats.

Social insights in action: Our ‘purrfect’ approach

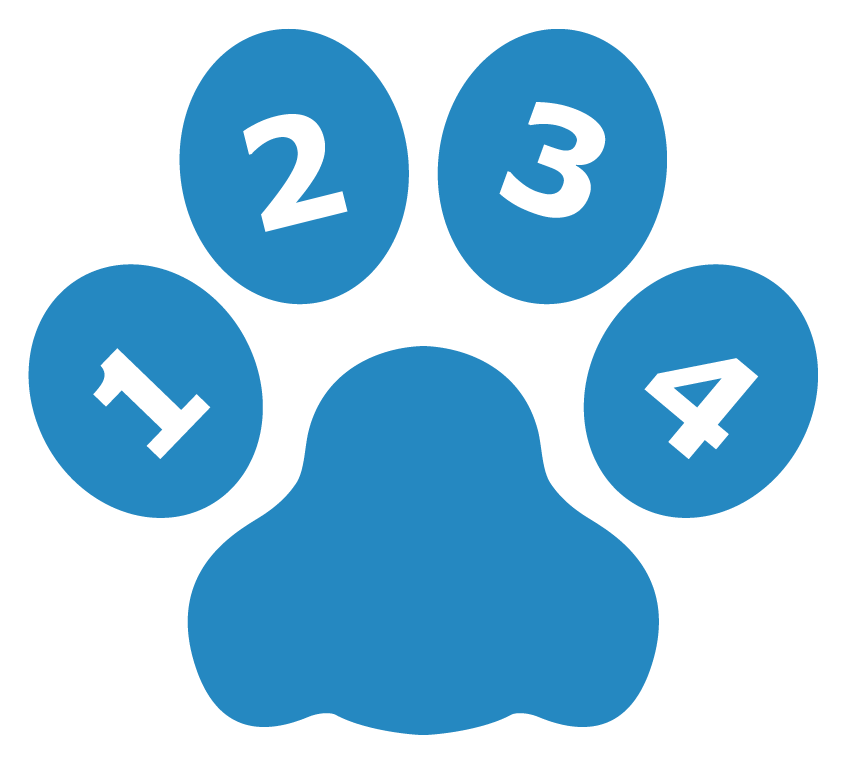

There are four distinct stages to our social insights research. These are illustrated by our cat food study. For this, we researched the social media conversations about cat food ingredients that occurred between 1 January and 31 July 2016.

We covered three markets – the UK, the US and France – and we only analyzed user‐generated discussions, not brand‐led ones.

Social insights in action: Our ‘purrfect’ approach

There are four distinct stages to our social insights research. These are illustrated by our cat food study. For this, we researched the social media conversations about cat food ingredients that occurred between 1 January and 31 July 2016.

We covered three markets – the UK, the US and France – and we only analyzed user‐generated discussions, not brand‐led ones.

Stage one:

Research set-up

At this stage, we define the research concept and strategy. We determine the keywords to search for across consumers’ publicly available conversations and shared content across websites/platforms. These include, e.g., relevant online discussion forums as well as Amazon, Facebook, Twitter and Instagram. For our cat food study, we looked for 20 keywords relating to feline food ingredients.

Stage two:

Software-based

data gathering

Based on the research set‐up, we run a software‐based search for relevant UGC. In our cat food study, this produced 1,800 consumer conversations and items of shared content for further analysis.

Stage three:

Human supervised data enrichment

Next, our analysts sift through the data collected. Using a ‘tag tree’ of agreed labels (parameters), they clean and classify the data. It is sorted according to relevance, topics, sentiment and also demographics. In this study, we worked with a tag tree containing more than 100 labels.

Stage ‘fur’

(we couldn’t resist!)

Our research team then reviews the data to turn the findings into actionable insights. These are delivered in a one‐off report that explores specific themes/trends in detail. The human expertise involved in stage two and three of the process makes the insights derived both robust and reliable. For example, in this study, our analysts classified posts according to sentiment to ensure this was done with an exceptionally high degree of accuracy (95%).

Stage one:

Research set-up

At this stage, we define the research concept and strategy. We determine the keywords to search for across consumers’ publicly available conversations and shared content across websites/platforms. These include, e.g., relevant online discussion forums as well as Amazon, Facebook, Twitter and Instagram. For our cat food study, we looked for 20 keywords relating to feline food ingredients.

Stage two:

Software-based

data gathering

Based on the research set‐up, we run a software‐based search for relevant UGC. In our cat food study, this produced 1,800 consumer conversations and items of shared content for further analysis.

Stage three:

Human supervised data enrichment

Next, our analysts sift through the data collected. Using a ‘tag tree’ of agreed labels (parameters), they clean and classify the data. It is sorted according to relevance, topics, sentiment and also demographics. In this study, we worked with a tag tree containing more than 100 labels.

Stage ‘fur’

(we couldn’t resist!)

Our research team then reviews the data to turn the findings into actionable insights. These are delivered in a one‐off report that explores specific themes/trends in detail. The human expertise involved in stage two and three of the process makes the insights derived both robust and reliable. For example, in this study, our analysts classified posts according to sentiment to ensure this was done with an exceptionally high degree of accuracy (95%).

Our four-step process

Research concept and strategy

Software-based data gathering and analysis

Human-supervised data enrichment

Actionable insights and consultancy

More than 20 search terms in relation to cat food ingredients were used. E.g. Cat food; Cat flavour; Cat food preservative..

Based on the research set‐up, we run software‐ based search and analytics on relevant topics

Data was cleaned, classified and enriched through a specific tag tree with more than 100 labels

Insights were delivered in a one‐off report with specific deep dives

Our four-step process

Research concept and strategy

More than 20 search terms in relation to cat food ingredients were used. E.g. Cat food; Cat flavour; Cat food preservative..

Software-based data gathering and analysis

Based on the research set‐up, we run software‐ based search and analytics on relevant topics

Human-supervised data enrichment

Data was cleaned, classified and enriched through a specific tag tree with more than 100 labels

Actionable insights and consultancy

Insights were delivered in a one‐off report with specific deep dives

True insight: Typical findings

So, what did we find in our study? More importantly, how might these be of benefit to your innovation, product development and marketing strategies?

True insight: Typical findings

So, what did we find in our study? More importantly, how might these be of benefit to your innovation, product development and marketing strategies?

Better target your campaigns: Discover more about your customers

If you’re planning a campaign with a digital element, you’ll want to know who this will engage. What is the profile of this group? Where do they hold conversations online? How do these things vary by market? Only with such information can you better target your campaigns and messaging to improve their effectiveness.

In our study, we identified that most conversations about cat food take place on shop and review websites. In the UK, such conversations take place on Amazon.co.uk, Pets at home and Zooplus.

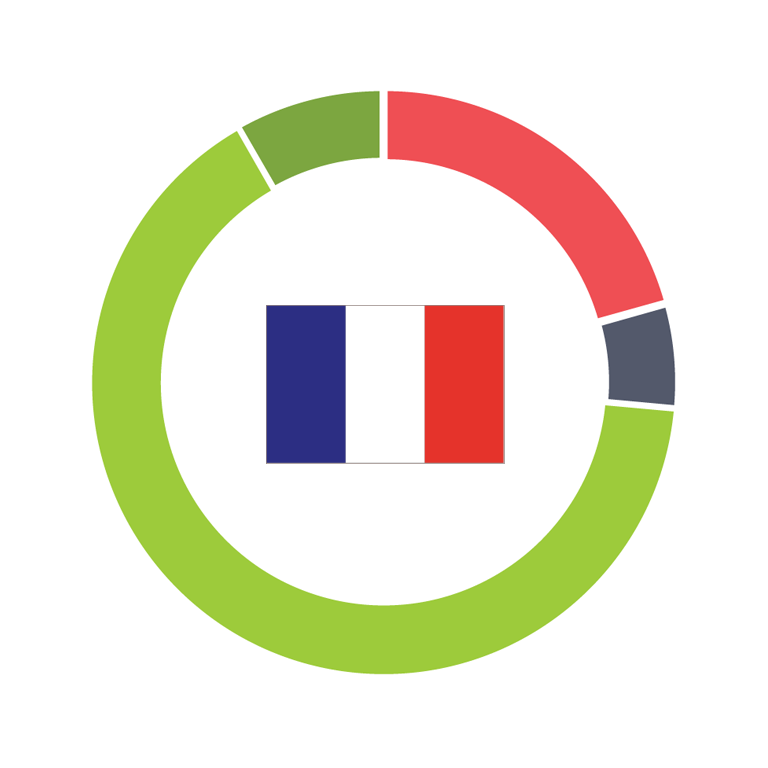

We found this to be the case in all three markets researched. We also discovered forums to be popular places to hold conversations about cat food. They’re the second most popular place in the UK and France, and the third most popular place in the US. Consumers in the US favor social media sites over forums.

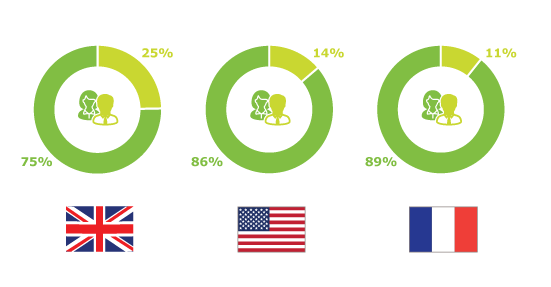

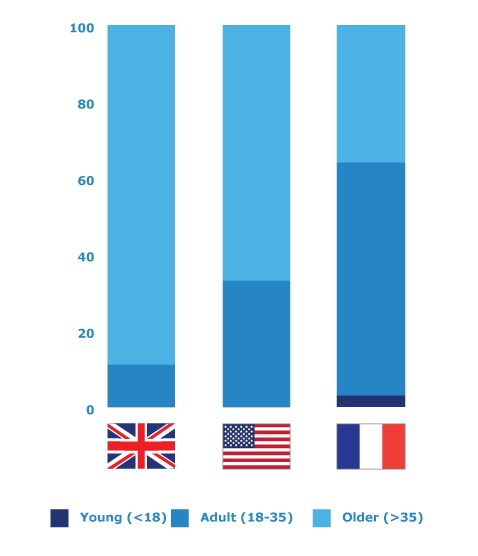

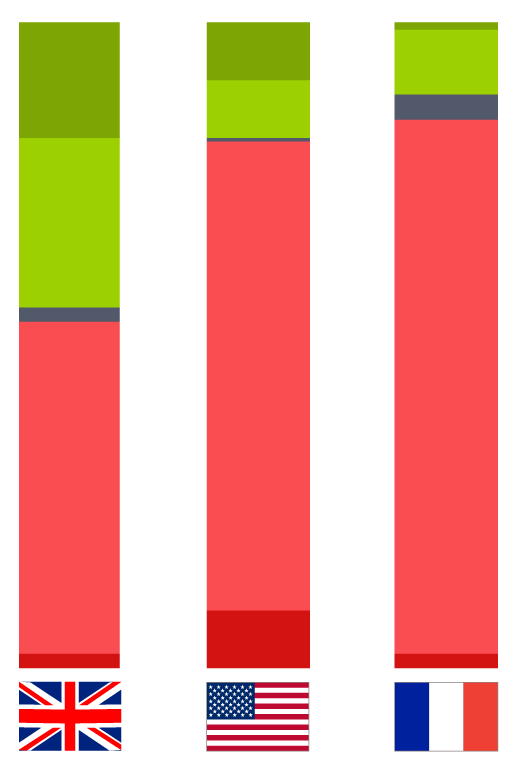

We further identified female consumers as being the most outspoken when sharing their views on cat food online. We found this to be particularly the case in two of the three markets in our study: the US and France. In the UK, we discovered men, aged 35+, to be most talkative on the topic of cat food. In contrast, we observed Millennials to be most vocal on the subject in France.

Look who’s talking

In the UK, more men and older consumers are talking online. Only in France millennials dominate the talk about cat food, in US and UK it’s older people who do that.

Look who’s talking

In the UK, more men and older consumers are talking online. Only in France millennials dominate the talk about cat food, in US and UK it’s older people who do that.

Direct innovation strategies: Understand what’s hot and what’s not

Before launching a new product concept, you’ll want to determine its likelihood of success across markets. How relevant is your product concept in each market?

By understanding what consumers are talking about online, you can uncover their potential level of interest in your idea. Critically, because social insights provide high‐quality intelligence fast, you can use them to inform innovation and go‐to‐market strategies.

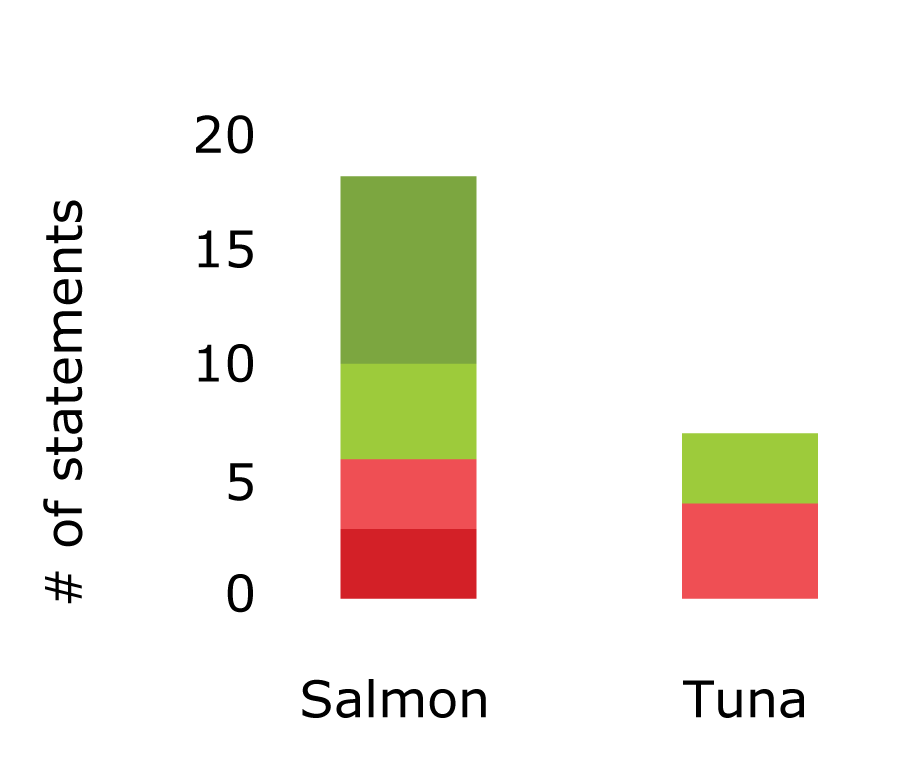

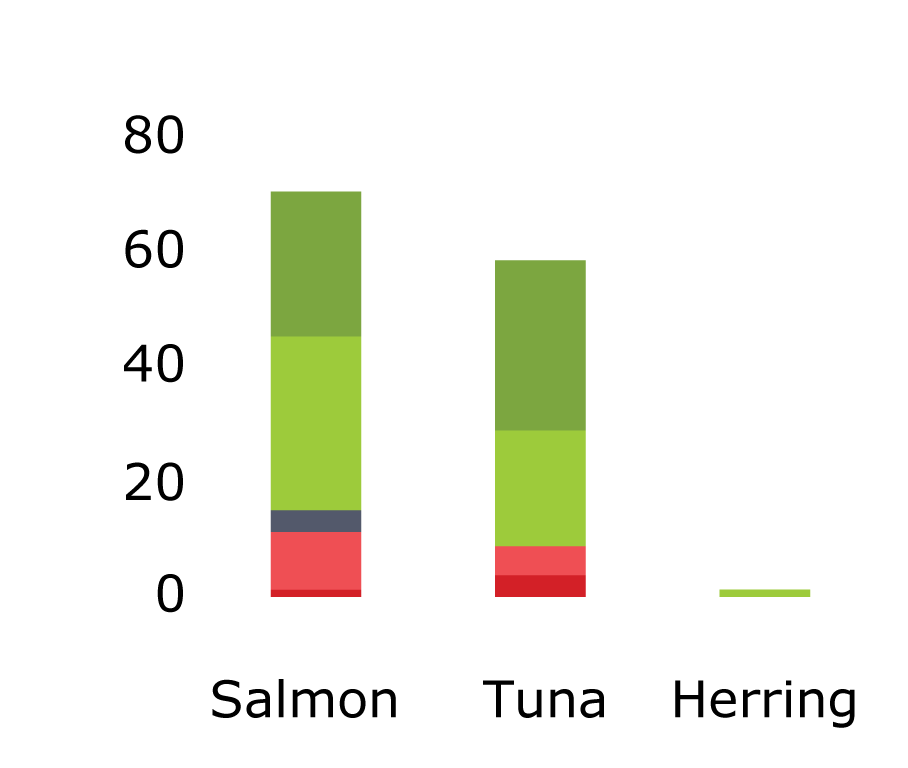

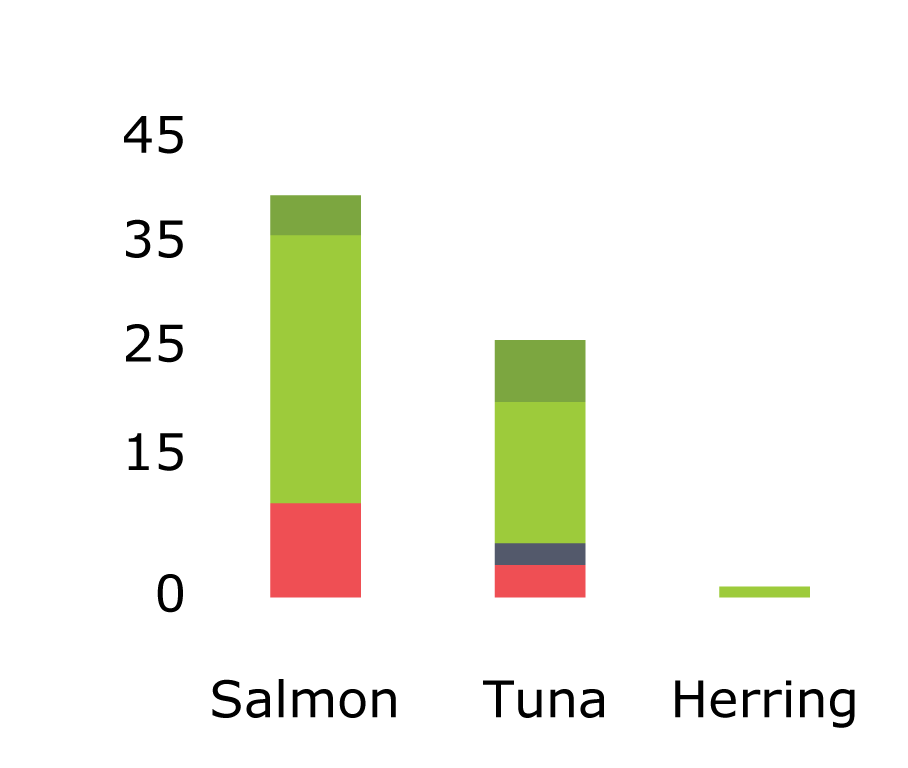

In our cat food study, conversations about ingredients centered around wet and dry food. We identified the top four most discussed ingredients as being meat, fish, grains and nutrients.

We discovered proteins to be the nutrients that people chat about most by far. And that consumers are most positive about cat food with high amounts of protein, believing it to have health benefits.

We found that consumers also talk about the flavor, health properties, price and look/smell of the food. And that they frequently discuss the popularity of different ingredients with their cats and the health benefits of these.

Direct innovation strategies: Understand what’s hot and what’s not

Before launching a new product concept, you’ll want to determine its likelihood of success across markets. How relevant is your product concept in each market?

By understanding what consumers are talking about online, you can uncover their potential level of interest in your idea. Critically, because social insights provide high‐quality intelligence fast, you can use them to inform innovation and go‐to‐market strategies.

In our cat food study, conversations about ingredients centered around wet and dry food. We identified the top four most discussed ingredients as being meat, fish, grains and nutrients.

We discovered proteins to be the nutrients that people chat about most by far. And that consumers are most positive about cat food with high amounts of protein, believing it to have health benefits.

We found that consumers also talk about the flavor, health properties, price and look/smell of the food. And that they frequently discuss the popularity of different ingredients with their cats and the health benefits of these.

Identify hot topics of conversation

Identify hot topics of conversation

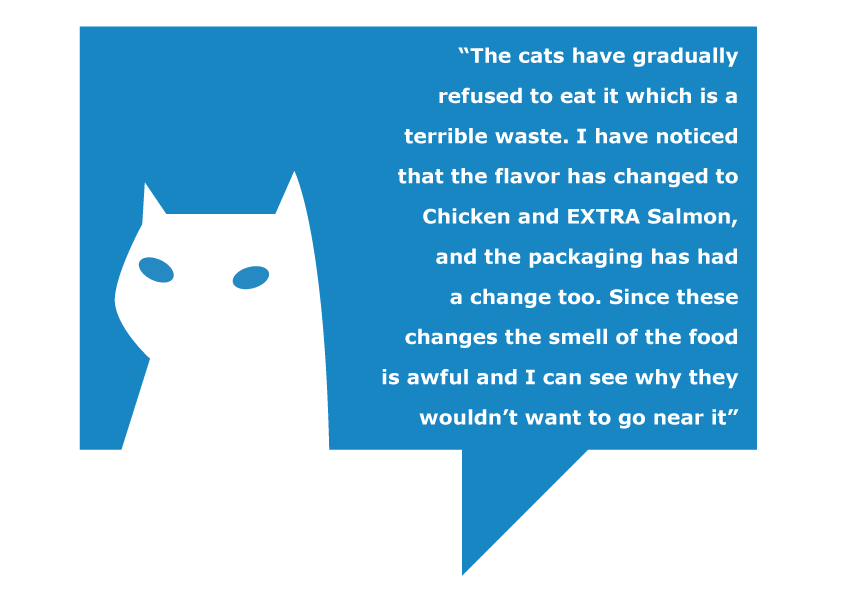

“[…] but do yourself a favor and avoid the chicken and salmon variety! It literally smells of horse manure. It turned my stomach and my cat’s stomach! And stank my kitchen out. Horrific”

“The cats have gradually refused to eat it which is a terrible waste. I have noticed that the flavor has changed to Chicken and EXTRA Salmon, and the packaging has had a change too. Since these changes the smell of the food is awful and I can see why they wouldn’t want to go near it”

Spot issues and opportunities: Understand consumer sentiment, what’s favored and what’s not

Social insights can clearly help you to better understand consumers and their interests and wants. However, the sentiment of what is talked about can help you to spot opportunities and threats.

Even more important, it can enable you to pinpoint issues requiring further research and where to make changes. What do people like and dislike about your offering? What could you improve?

Do you need to change your product, distribution or communications strategy? Is further, more structured qualitative or quantitative consumer research required to inform your actions?

Spot issues and opportunities: Understand consumer sentiment, what’s favored and what’s not

Social insights can clearly help you to better understand consumers and their interests and wants. However, the sentiment of what is talked about can help you to spot opportunities and threats.

Even more important, it can enable you to pinpoint issues requiring further research and where to make changes. What do people like and dislike about your offering? What could you improve?

Do you need to change your product, distribution or communications strategy? Is further, more structured qualitative or quantitative consumer research required to inform your actions?

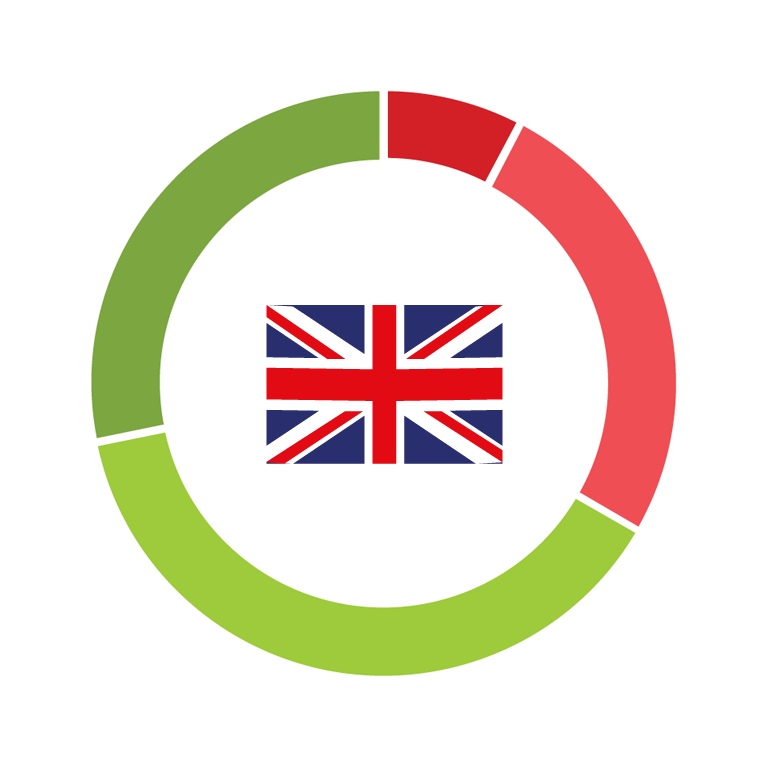

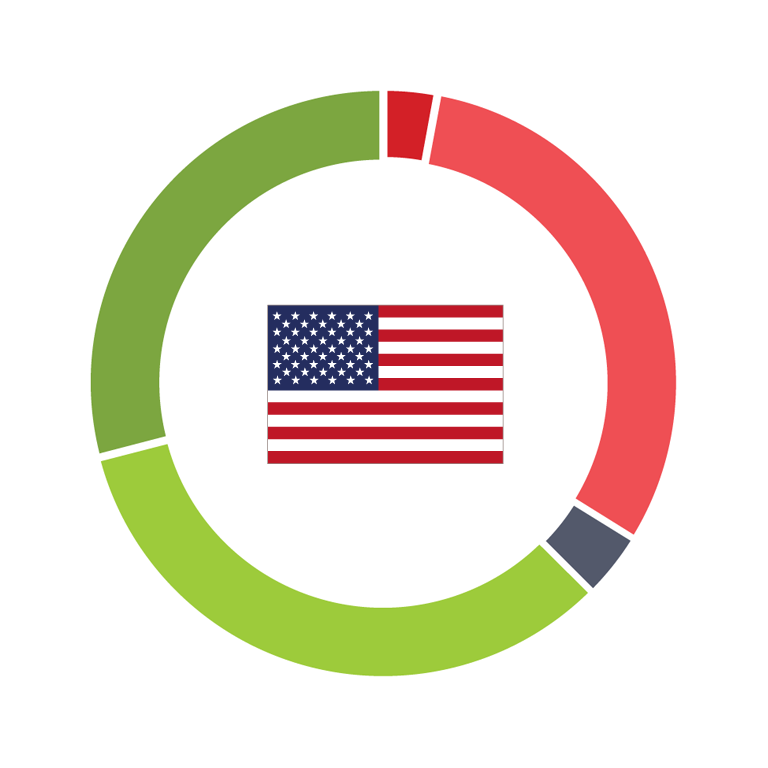

An example, based on our cat food study, of the intelligence that can be generated by social insights

We also found an interesting trend: that pet owners in all three markets talk negatively about grains as an ingredient. They avoid them because they believe them to be fillers with little nutritional value. Moreover, they perceive cats as carnivores by nature and therefore prefer to feed their pets meat. This tendency is more remarkable in the US and France.

We also found an interesting trend: that pet owners in all three markets talk negatively about grains as an ingredient. They avoid them because they believe them to be fillers with little nutritional value. Moreover, they perceive cats as carnivores by nature and therefore prefer to feed their pets meat. This tendency is more remarkable in the US and France.

Sentiment about grains as an ingredient

Key benefits of social insights

Social insights provide fresh information on the attitudes and behaviors of an ever-increasing number of digitally-savvy consumers. By combining them with traditional research techniques, you can obtain a more complete picture of your existing and potential customers.

They offer you insights with breadth and depth on an incredible scale at speed. Such timely information is needed in today’s competitive market if you are to gain a competitive edge.

With it you can:

- Better understand who your consumers are, and where to find them online.

- Direct innovation and go- to-market strategies – by obtaining insight into what key consumer groups want and are most interested in by market.

- Identify opportunities and threats, and the need for further research – by examining the sentiment of consumer conversations.

Authors

Jolique Weelink

Global Head of Innovation and Growth

Gilbert Saktoe

Social Insights Researcher

Discover more…

…about our ‘purrfect’ social insights:

contact us

About MetrixLab

MetrixLab provides consumer insights that drive smarter business decisions. A truly global digital research agency, we pioneer new technologies and integrate multiple data sources to push the boundaries of research. This enables our experts to provide high-quality insights at scale, at speed and for an unparalleled value. Our passion, expertise, and solutions enable our clients to succeed at product innovation, brand engagement, and consumer value.

Active in over 90 countries, MetrixLab is a proud partner of more than half of the world’s top 100 brands and part of Toluna.

MetrixLab operates a Social Insights Privacy Policy, which takes into account the privacy of people publishing content online.